Usage-Based Insurance (UBI) is a recent innovation by auto insurers that more closely aligns driving behaviors with premium rates for auto insurance.

Usage based Insurance Telematics

Usage-Based Insurance (UBI) is a recent innovation by auto insurers that more closely aligns driving behaviors with premium rates for auto insurance.

In this article, you will know:

Usage-Based Insurance (UBI) is a kind of car insurance that tracks mileage and driving behaviors. Nowadays, the realization of UBI insurance is mainly through Telematics technology like Telematics tracking devices and platforms.

UBI tries to distinguish and award “safe” drivers, providing them reduced premiums.

For example:

If the vehicle driver drives carefully as well as drives fewer miles each year will save 10%-15% yearly with UBI car insurance.

UBI provides drivers an economic reward to drive less as well as depending on the driving details monitored, to drive much more carefully. The more positively they react to the insurance reward, the less they pay for their insurance.

On the other hand,

Commercial fleet management and driver monitoring also benefit a lot from UBI definitely.

Through the improvement of the driver behavior, they can lower the whole insurance premiums. Meanwhile, improve operational effectiveness and driver safety largely.

At the technology level, Usage based insurance relies on telematics technology like driver sharing information on driving behavior and car miles.

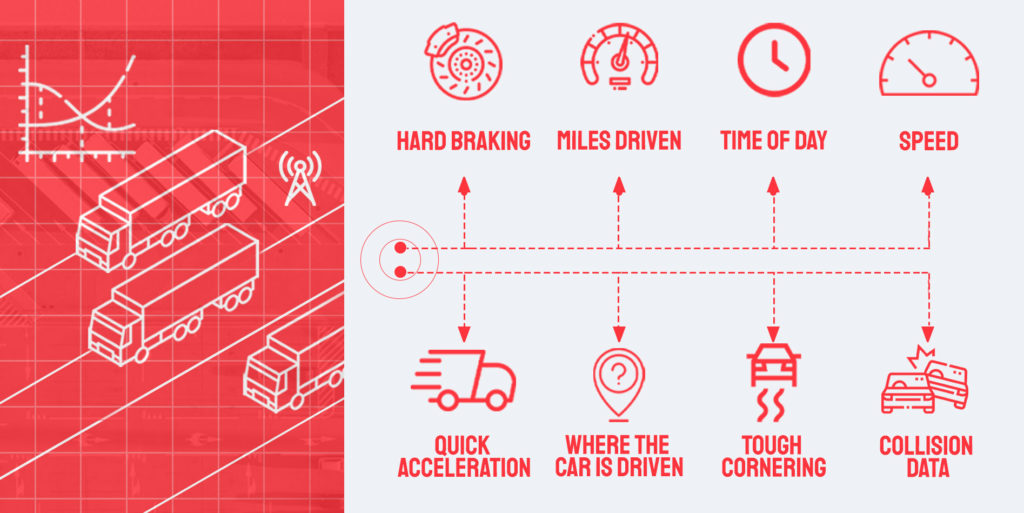

Within years of improvement of vehicle telematics, telematics devices and software platforms now can collect and analyze more accurate and numerous data that usage based insurance needed, including:

The insurers analyze the information collecting by the telematics devices. From the data, insurers can much better value the insurance premium more accurately.

The main reason that a lot of individuals or firms attempt usage-based insurance is for the discounts rates.

Insurance companies are offering up to a 10-25% premium discount for good driving scores. Therefore, many individuals are selecting to offer this type of insurance a shot.

Typically, if you continue to obtain the discount each year, it is an excellent reason to keep using it.

Frequently, insurance-approved vehicle trackers come with tracking hardware and software platforms that allows vehicle manager to track where your cars and lorries are and alert you if they leave a geofencing zone.

That means,

A Usage Based Insurance Telematics device and platform also boot your fleet management.

For companies that intend to monitor their fleet of vehicles, knowing where their young drivers are going is very important for fleet monitor and control. Telematics-based car insurance and geofencing tools can be extremely valuable. You can often set up additional tracking regulations, such as getting a text alert when your car exceeds the speed limit.

Drivers typically only slightly recognize the link between their safe driving and how their insurance is priced. Unless their insurance premium rises up significantly after an accident or speeding ticket.

Another extra advantage of Usage based insurance is improving driver behavior.

UBI provides immediate feedback and alerts when bad driving behavior happens. For example, this basic information can be collected to improve driver performance.

Miles driven, frequency of operation, braking and acceleration.

If you or a lorry you own is involved in an accident, it is much easier to do forensics when there is GPS information leading up to the incident. The authorities and insurance claims adjusters can use telematics information, such as the braking intensity, speed, and acceleration, to identify what went wrong and settle the claim more accurately.

Usage based Insurance is a win-win solution for consumers and insurers and fleet managers. Base on this potential marketplace, Gosafe has developed a specific device for tracking driving behavior and driving data.

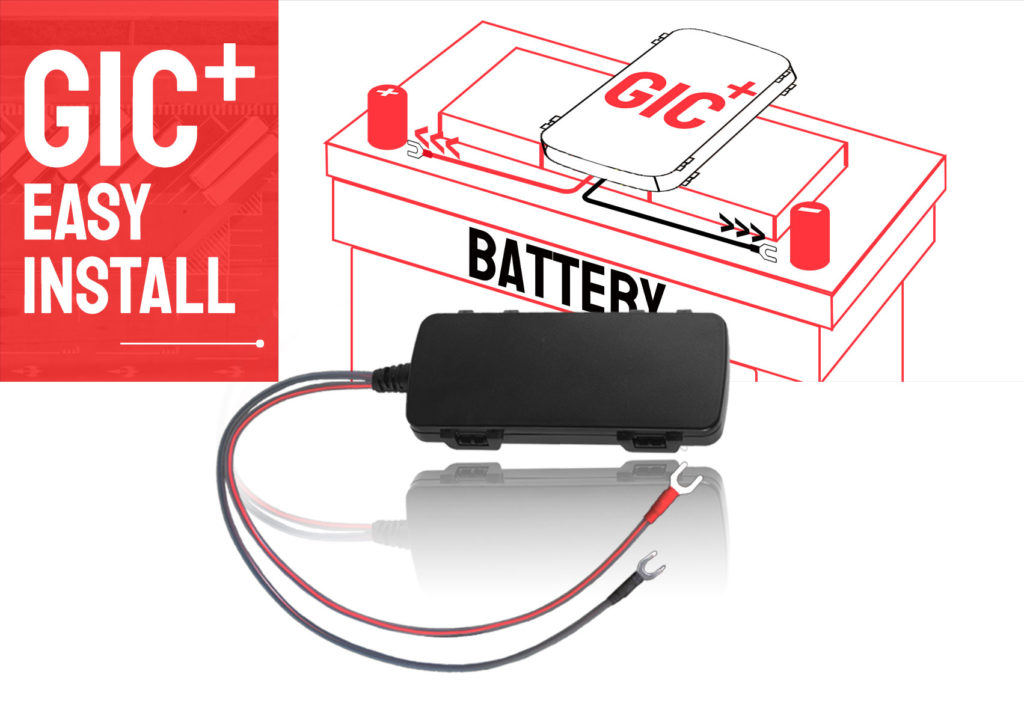

G1C +Easy Install is the most popular telematics tracking device in usage based Insurance(UBI).

The G1C+ easy install is an easy small and economical vehicle tracking device specially designed to address the high installation cost and high precision location. Powerful internal antennas and water resistance allow this tracking device can directly connect to the car battery terminal.

The built-in accelerometer can offer trip detection, driving behavior and turn by location. G1C+ easy install is an ideal solution for insurance telematics, rental and leasing, light vehicle fleets and many more.

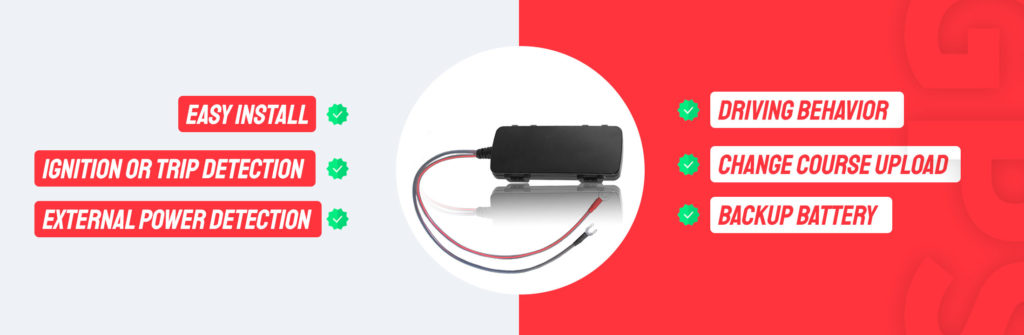

Meanwhile, it is a reliable telematics device with almost all basic features:

The two wires can directly connect to the vehicle battery

The inbuilt accelerometer can help to detect the trip and ignition sensing

The device can offer external power voltage to give a better understanding of car battery status.

The built-in 3D accelerometer generates hard braking, acceleration and turning events to the backend server for driving scoring

The device automatically uploads the data when the vehicle is driving on winding roads to show a good track.

The device comes with built-in backup battery in case of someone temper with the main power.

Gosafe Company Limited is a global innovator in Telematics devices, offering a range of hardware and powerful telematics tracking solution. Now, our GPS device across more than 100 countries around the world.

During 16 years of development, we have developed mature GPS trackers product lines like Fleet tracker, Asset tracker, Plug n Play Tracker, and Ankle bracelet tracking.

Furthermore,

We have supported various customers in transportation and logitstics, supply chain, heavy equipment, maritime, and government.

We offer complete OEM/ODM services to be selected. We have a complete process in place to fulfill clients’ requirements, We have comprehensive sales and after-sales team.

We always keep move on, offer cutting-edge technology to increase our client’s productivity, visibility and ROI.